With each dollar in sales earned beyond the break-even point, the company makes a profit. Conversely, retail stores tend to have low fixed costs and large variable costs, especially for merchandise. Because retailers sell a large volume of items and pay upfront for each unit sold, COGS increases as sales increase. By breaking down the equation, you can see that DOL is expressed by the relationship between quantity, price and variable cost per unit to fixed costs. If operating income is sensitive to changes in the pricing structure and sales, the firm is expected to generate a high DOL and vice versa.

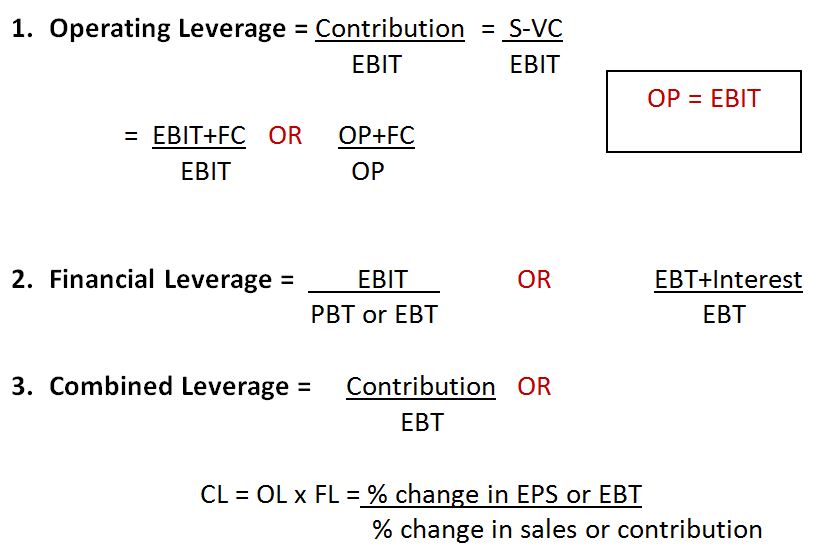

What Is the Difference Between Operating Leverage and Financial Leverage?

An effective pricing structure can lead to higher economic gains because the firm can essentially control demand by offering a better product at a lower price. If the firm generates adequate sales volumes, fixed costs are covered, thereby leading to a profit. The Degree of Operating Leverage (DOL) measures how a company’s operating income responds to changes in sales. It provides insight into the relationship between fixed and variable costs and their impact on profitability.

How to Calculate Operating Leverage

Integrate DOL calculations into your financial planning strategies for better long-term decision-making. Understanding how changes in sales volume affect your operating income allows for more precise forecasting and budgeting. Use the calculator as a strategic tool for enhancing your financial planning efforts.

Which of these is most important for your financial advisor to have?

Finally, it is essential to have a broad understanding of the business and its financial performance. We put this example on purpose because it shows us the worst and most confusing scenario for the operating leverage ratio. Additionally the use of the degree of operating leverage is discussed more fully in our operating leverage tutorial. Use the calculator to assess the risk and reward trade-offs for your growth strategies. Operating Leverage is controlled by purchasing or outsourcing some of the company’s processes or services instead of keeping it integral to the company.

- The only difference now is that the number of units sold is 5mm higher in the upside case and 5mm lower in the downside case.

- The reason operating leverage is an essential metric to track is because the relationship between fixed and variable costs can significantly influence a company’s scalability and profitability.

- The more fixed costs there are, the more sales a company must generate in order to reach its break-even point, which is when a company’s revenue is equivalent to the sum of its total costs.

The degree of operating leverage (DOL) is a multiple that measures how much the operating income of a company will change in response to a change in sales. Companies with a large proportion of fixed costs (or costs that don’t change with production) to variable costs (costs that change with production volume) have higher levels of operating leverage. The DOL ratio assists analysts in determining the impact of any change in sales on company earnings or profit. Operating leverage measures a company’s fixed costs as a percentage of its total costs. It is used to evaluate a business’ breakeven point—which is where sales are high enough to pay for all costs, and the profit is zero. A company with high operating leverage has a large proportion of fixed costs—which means that a big increase in sales can lead to outsized changes in profits.

This structure provides stability, as lower fixed costs mean the company doesn’t require high sales volumes to cover its expenses. A high degree of operating leverage provides an indication that the company has a high proportion of fixed operating costs compared to its online xero courses variable operating costs. It also means that the company can make more money from each additional sale while keeping its fixed costs intact. As a result, fixed assets, such as property, plant, and equipment, acquire a higher value without incurring higher costs.

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. As a hypothetical example, say Company X has $500,000 in sales in year one and $600,000 in sales in year two.

Another way to control this operational expense line item is to reduce unnecessary expenses, especially during slow seasons when sales are low. The only difference now is that the number of units sold is 5mm higher in the upside case and 5mm lower in the downside case. Companies with high DOLs have the potential to earn more profits on each incremental sale as the business scales. Later on, the vast majority of expenses are going to be maintenance-related (i.e., replacements and minor updates) because the core infrastructure has already been set up. A company with a high DOL coupled with a large amount of debt in its capital structure and cyclical sales could result in a disastrous outcome if the economy were to enter a recessionary environment. The DOL would be 2.0x, which implies that if revenue were to increase by 5.0%, operating income is anticipated to increase by 10.0%.